From molecules to marketplace, communication strategies within the ingredients-to-consumer value chain evolve in distinct ways.

In industries such as pharmaceuticals, nutraceuticals, food & beverage and personal care, "ingredients" refer to the raw materials or active components. These ingredients often originate from specialized manufacturers and are used in the development of finished products that ultimately reach the end user.

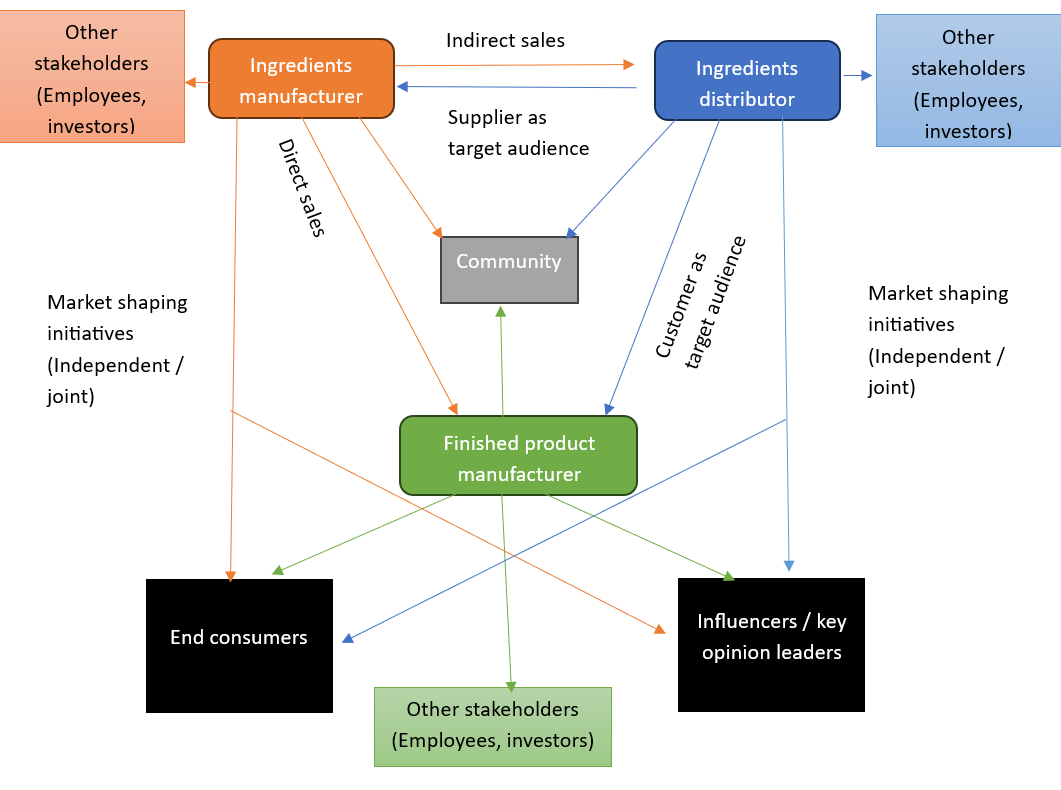

As one travels from ingredient manufacturers to end consumers, the messaging and mediums used by businesses shift in tone, target and intention. Communication transforms significantly across three primary types of companies: ingredients manufacturers, distributors and finished product manufacturers, dictated by their position in the value chain.

Ingredients Manufacturers: Building Awareness and Trust

At the beginning of the chain, an ingredients manufacturer (Company 1) is typically focused on promoting the unique strengths of their ingredients. Its audience varies depending on their mode of sale, either selling via a distributor (Company 2) or direct sales to finished product manufacturers (Company 3).

The messaging also shifts depending on market maturity. In untapped or emerging markets, where the ingredient itself is relatively unknown, the focus is on highlighting its innovation, quality, or functional benefits. The primary task is to educate the market and create awareness around the ingredient's value proposition. In contrast, in more established markets where the ingredient is already recognized, the emphasis often shifts toward showcasing the strength, expertise and credibility of the company behind it.

Brand architecture for such companies traditionally leans toward a branded house model, where the corporate brand name supports a suite of products often in their generic form. However, some market leaders who have already established themselves as branded houses are moving toward a house of brands strategy, especially when launching branded ingredients that require standalone identities.

Distributors: Creating Value Between Suppliers and Customers

The distributor, or Company 2, must communicate both upstream to suppliers (Company 1) and downstream to their customers, i.e., finished product manufacturers (Company 3). The primary strategic communications goal is to position itself as more than just a logistics intermediary by highlighting its value proposition, such as market knowledge, technical formulation support and/or supply chain efficiency. In a competitive landscape where other distributors are vying for the same partners, and where some suppliers are choosing to sell directly to customers, it's critical for distributors to differentiate themselves as partners who enhance the success of both suppliers and customers. Communication campaigns emphasize their role in bridging gaps, enabling innovation and supporting faster go-to-market strategies.

Therefore, a branded house approach is considered the most suitable for distributors to build and maintain a strong corporate identity benefitting from consistency and recognition.

Finished Product Manufacturers: Engaging Consumers and Influencers

At the consumer-facing end of the chain, finished product manufacturers (Company 3) target the most diverse and complex audience. Take the consumer healthcare industry, for instance, where end consumers may be users or buyers, while influencers include fitness experts or nutritionists. Communication strategies must be carefully segmented to address the differing priorities of each group. For end users, the messaging typically emphasizes brand value, emotional appeal and ease of use, focusing on how the product fits into their daily lives or improves well-being.

On the other hand, communication aimed at influencers is grounded in data on efficacy and safety. Within this influencer segment exists an even more specialized group: Key Opinion Leaders (KOLs) who are highly respected experts such as senior dieticians or academic figures whose opinions hold significant weight. These KOLs often influence not just buyers but also the broader narrative within the influencer community, creating a ripple effect that builds credibility and drives adoption across the ecosystem.

Finished product manufacturers often follow a house of brands model, where each product has its own identity. However, for targeting employees, investors, or suppliers, these companies are now strengthening their branded house identity. This dual strategy helps attract talent and partnerships while still focusing product-level communication on the end user. Finished product manufacturers are often the final storytellers in the supply chain, bringing the combined value of the entire chain to life in the eyes of consumers.

How Communication Strategies Shift Across the Value Chain

|

|

Who is the target audience?

|

Why are you communicating (your key message)?

|

What is the brand architecture?

|

Where do you communicate (channels)?

|

|

Ingredients Manufacturer (Company 1)

|

Direct sales → Company 3

Indirect sales → Company 2

|

Strength of ingredient → Untapped markets

Strength of company → Established markets

|

Branded house (traditionally) → House of brands (branded ingredients launch)

|

Targeted: Expos, B2B magazines, digital campaigns, seminars/webinars

|

|

Distributor (Company 2)

|

Supplier → Company 1

Customer → Company 3

|

Value addition beyond being a logistics partner (market understanding, formulation support)

|

Branded house (to strengthen corporate identity)

|

|

Finished Product Manufacturer (Company 3)

|

End consumers

Influencers/KOLs

|

To showcase the product and corporate brand

To build awareness on application areas

|

House of brands (traditionally consumers recall the product, not company)

Leaders focusing on building a branded house (to attract potential employees, investors, and suppliers)

|

Mass media as well as targeted campaigns for specific audiences, such as influencers or buyers

|

Note: The above target audience excludes other stakeholders, such as employees, investors, or the broader community, who are typically engaged through corporate social responsibility communications.

Special Cases: When B2B Players Talk to Consumers

Special cases exist where business-to-business (B2B) companies, such as ingredient manufacturers or distributors, communicate directly with end consumers or influencers. This can occur when the ingredient brings a clear consumer benefit such as sustainability, quality or unique health claims. Sometimes, these upstream players co-invest with finished product manufacturers in awareness campaigns. Such collaborations tend to materialize when there’s a clear win-win dynamic, especially when both the B2B and business-to-consumer (B2C) partners are market leaders in the region. By jointly educating consumers, these efforts grow the overall market, benefiting all players involved. Strategic communications alignment becomes a force multiplier, turning individual strengths into shared success across the value chain.

Visualizing Communication Strategy

This flow chart visualizes how communication strategies must shift across different roles. At each point in the value chain — including manufacturer, distributor, and finished product manufacturer — companies must not only speak to their direct customers but also consider broader audiences.

Communication strategy is far from one-size-fits-all. The value chain may be linear, but the messaging that powers it is anything but.